Colorado owes $1.7 billion in TABOR refunds — Here’s when taxpayers can expect their share

Colorado Legislative Council StaffCourtesy photo

Colorado taxpayers can expect tax refunds in 2025 following the announcement of over $1 billion in excess state revenues.

The Colorado government’s revenue for the 2024 fiscal year is almost $1.4 billion over the limit set by the Taxpayer’s Bill of Rights, commonly called TABOR.

TABOR, a constitutional amendment passed by voters in 1992, limits the amount of taxes the state can collect and retain. Any money raised above the limit must be returned to taxpayers.

Combined with $288 million in excess revenues not refunded in the 2023 fiscal year, the state government owes taxpayers nearly $1.7 billion in refunds, according to the state auditor’s October TABOR Financial Report.

The excess collected in 2024 was lower than the previous year, when the state collected $3.6 billion more in revenue than TABOR allowed.

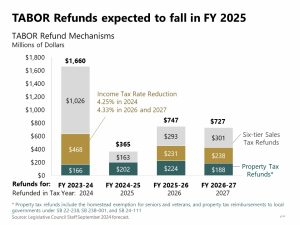

Last year, Colorado taxpayers received refunds of $800 each. This year, auditors report three mechanisms available for refunding excess state revenues:

- A property tax exemption reimbursement through local government for qualifying seniors and disabled veterans, which is expected to cover $166 million in reimbursements.

- A temporary income tax rate reduction to 4.25%, expected to pay $468 in reimbursements.

- A six-tier sales tax refund mechanism based on the adjusted gross income of each recipient, expected to make up over $1 billion in reimbursements.

Through the six-tier sales tax refund, lower income earners will receive a lower refund than higher income earners. A September Economic and Revenue Forecast report from the Legislative Council Staff projects the following refund amounts based on adjusted gross income:

- Incomes up to $53,000: $181 single filers, $362 joint filers

- $53,001 to $107,000: $241 single, $482 joint

- $107,001 to $172,000: $277 single, $554 joint

- $172,001 to $243,000: $330 single, $660 joint

- $243,001 to $320,000: $355 single, $710 joint

- $320,001 and over: $571 single, $1,142 joint

The fiscal year 2024 excess state revenues are expected to trigger all three refund mechanisms, which will be paid out in spring 2025.

According to a social media post by the Legislative Council Staff, TABOR refunds are expected to fall next year from $1.7 billion to $365 million, which will eliminate the income tax rate-reduction refund mechanism for 2025.

Support Local Journalism

Support Local Journalism

Readers around Craig and Moffat County make the Craig Press’ work possible. Your financial contribution supports our efforts to deliver quality, locally relevant journalism.

Now more than ever, your support is critical to help us keep our community informed about the evolving coronavirus pandemic and the impact it is having locally. Every contribution, however large or small, will make a difference.

Each donation will be used exclusively for the development and creation of increased news coverage.